Enhance your banking and investment services with Lopaa’s automation. Streamline loan processing, credit card management, investment insights, and account services, all while improving efficiency and customer experience.

Streamline your loan processing with AI-powered verification, risk assessment, and automated approvals. Reduce processing time from weeks to minutes.

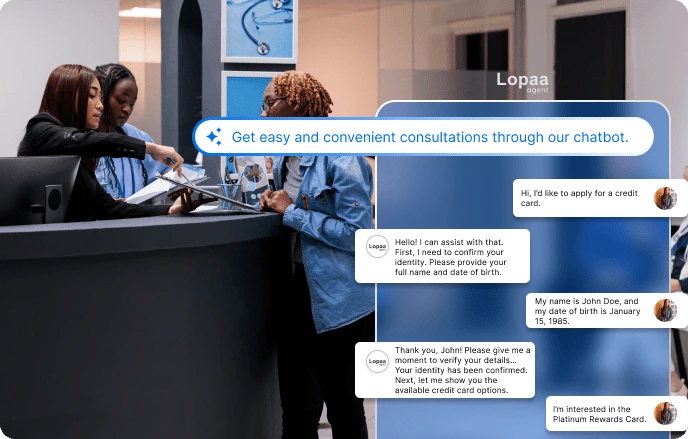

Provide 24/7 automated support for account services, fund transfers, and credit card applications. Handle high volumes of customer queries instantly.

Access mobile banking services effortlessly. Connect with us via chat for quick assistance and secure transactions.

Enhance customer engagement with a seamless financial consultation process. Provide personalized banking and credit advisory services efficiently.

Leverage customer feedback to improve banking services and enhance overall satisfaction with data-backed insights.

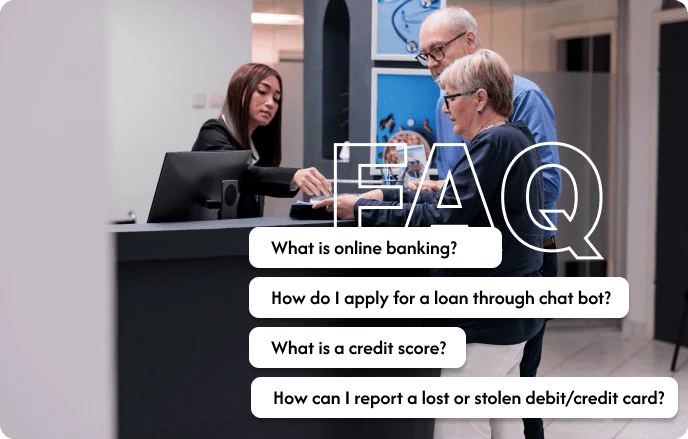

Equip customers with an intuitive FAQ system covering key banking topics, ensuring better self-service and reduced support queries.

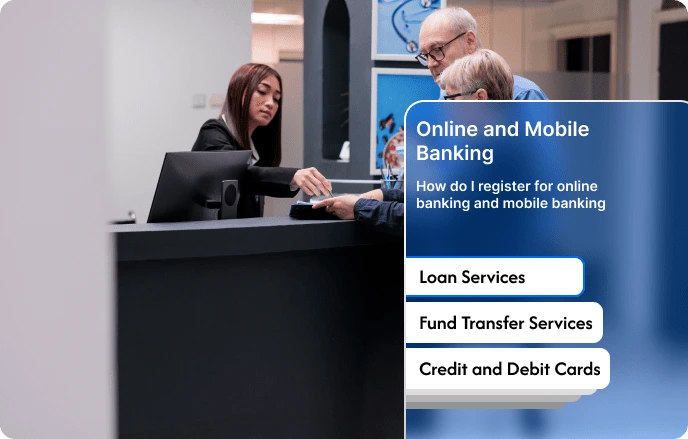

Deliver a seamless and secure banking experience through enhanced digital banking platforms, covering everything from transactions to loan applications.

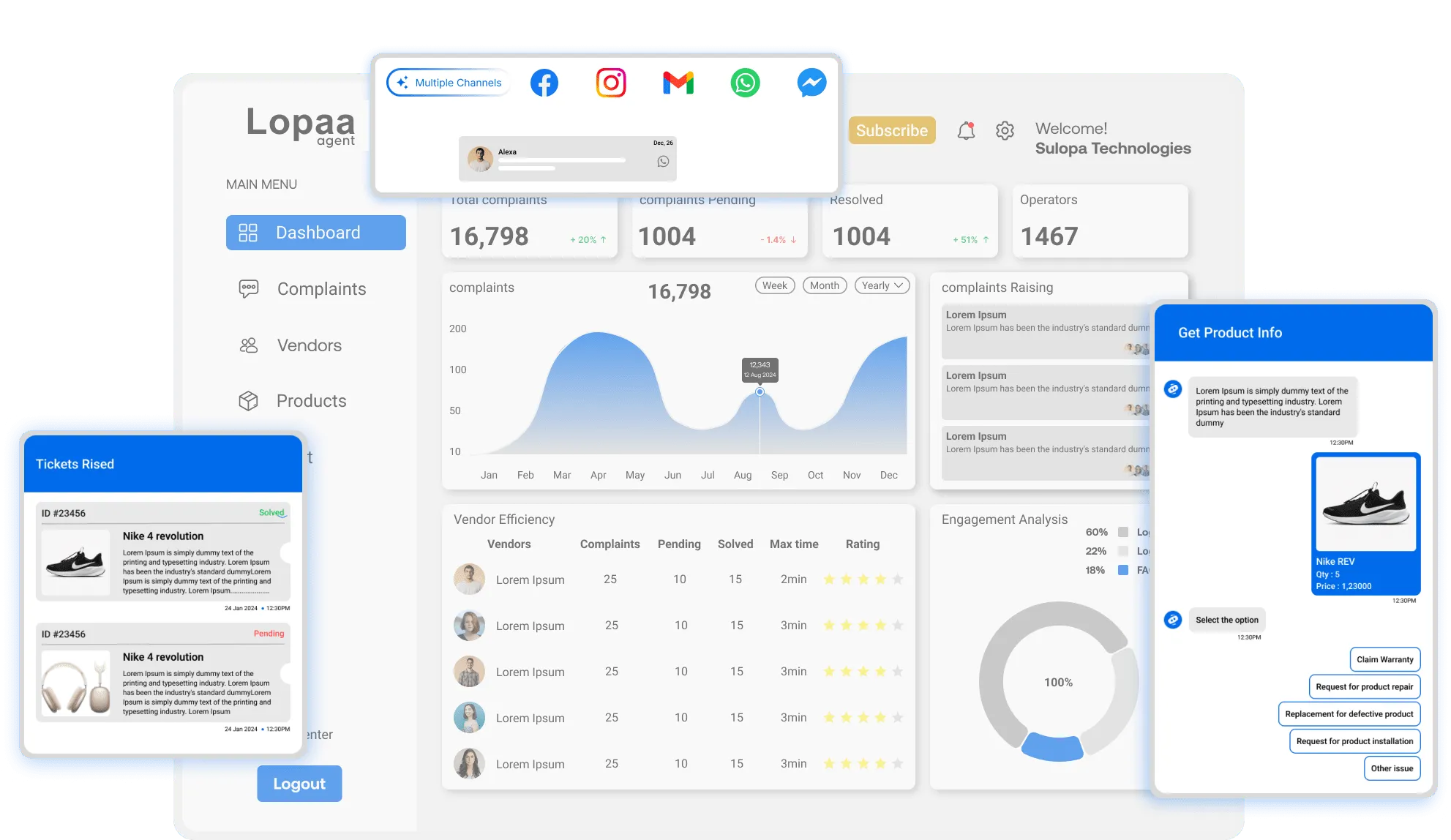

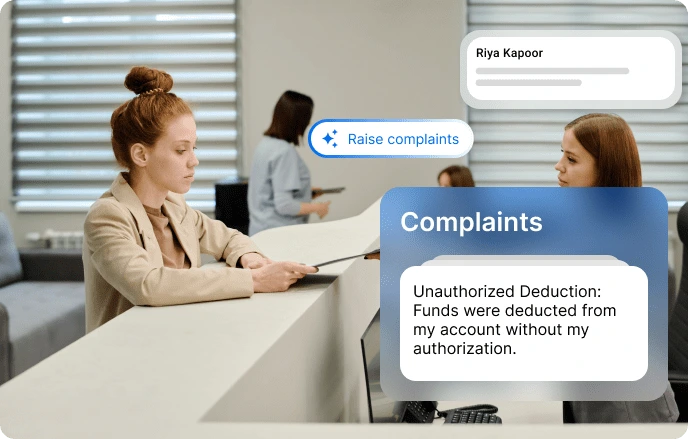

Implement a structured complaint resolution process, ensuring quick response times and effective issue handling to maintain customer trust.

Boost the standards of data security, customer support culture, and scalability to streamline process management, monitor performance, and drive growth.

Streamline back-office teamwork.

Convert enquiries into actionable tickets.

Seamlessly coordinate tasks across channels.

Provide tailored insights for a personalized experience.

Manage multiple conversations anytime

Deliver faster, consistent responses.

Enable self-service and proactive chat.

Ensure no conversation is ever lost.

Simplify shopping with discounts & tracking.

Change chatbot UI color.

Automate conversation triage.

Set up keyword-based autoresponders.